The stock market took a sharp dive, dropping nearly 1,000 points after President Donald Trump announced new tariffs targeting China and the European Union. The tariffs, which are expected to impact key industries, sparked concerns among investors, leading to a significant market reaction. CBS correspondent Natalie Brand reported on the situation from the White House.

Market Uncertainty Following Tariff Announcement

President Trump’s tariff plan is aimed at addressing trade imbalances, but it has raised fears of economic retaliation from China and the EU. Investors worry that these tariffs could escalate into a broader trade conflict, leading to higher costs for businesses and consumers. As a result, stock prices tumbled, with major indices experiencing steep declines.

The drop in the stock market reflects uncertainty about how these tariffs will affect international trade and the global economy. Experts say that if China and the EU respond with their own tariffs, it could lead to disruptions in supply chains and increased prices for goods. This has made investors cautious, resulting in the sharp sell-off.

Impact on Key Sectors

Industries most affected by the tariffs include manufacturing, technology, and agriculture. Many American companies rely on imports from China and Europe, and higher tariffs could mean increased production costs. Investors reacted swiftly to the news, pulling money out of stocks and causing market volatility.

Financial analysts warn that continued uncertainty could lead to more fluctuations in the stock market. While some companies might benefit from protectionist policies, others could suffer from decreased international demand and rising costs.

White House Response

The White House has defended the decision, stating that the tariffs are necessary to protect American industries from unfair trade practices. President Trump has repeatedly argued that China and the EU have taken advantage of the U.S. in trade agreements, and these tariffs are part of his strategy to level the playing field.

Despite the market’s negative reaction, the administration remains firm on its trade policies. Officials have hinted at the possibility of further negotiations with China and the EU, but no immediate changes to the tariff plan have been announced.

What’s Next for the Market?

Market analysts say the coming days will be critical in determining whether this decline is a temporary dip or the start of a longer downturn. Investors will be watching closely for any signs of trade negotiations or potential retaliatory measures from China and the EU. Until then, market volatility is expected to continue as uncertainty remains high.

Business

Tanzania Lifts Ban on Agricultural Imports from Malawi, South Africa

Tanzania has lifted its recently imposed ban on agricultural imports from Malawi and South Africa to allow diplomatic talks aimed at resolving the dispute.

California Surpasses Japan to Become World’s Fourth Largest Economy

California’s economy has officially surpassed Japan’s, making the U.S. state the fourth largest economy in the world.

Bank of Ghana to Start Regulating Cryptocurrency by September 2025

The Bank of Ghana (BoG) plans to begin regulating cryptocurrency platforms and virtual asset providers by the end of September 2025, according to Governor Dr.

Real Estate Boss Faces Court Over Ksh.6.4M Syokimau House Scam

A real estate company boss is facing legal action after allegedly scamming a customer out of Ksh.6.4 million for a house in Syokimau.

Kenya Airways Diverts Flights from JKIA Due to Heavy Fog

Early this morning, heavy fog covered much of Nairobi, leading to flight disruptions at Jomo Kenyatta International Airport (JKIA).

Ghana’s Producer Price Inflation Drops to 24.4% in March 2025

Ghana's Producer Price Inflation (PPI) fell to 24.4% in March 2025, down from 27.6% in February, according to new data from the Ghana Statistical Service (GSS).

Access Holdings Reports N642bn Profit and 88% Revenue Growth

Access Holdings Plc has announced a profit after tax of N642 billion for the full year ending December 31, 2024, marking a 3.7 percent increase from the N619.32 billion posted in 2023.

MOGO Uganda and Airtel Launch Affordable Smartphone Loan Plan

MOGO Uganda, a leading asset financing company, has teamed up with Airtel Uganda to offer an affordable smartphone loan program aimed at increasing access to Tecno, Infinix, and itel devices for Ugandans.

Umeme Declares Dispute With Government Over Buyout Disagreement

Umeme Limited has officially raised a dispute with the Government of Uganda over the Buy Out Amount owed at the end of its electricity distribution concession.

Access Bank Acquires National Bank of Kenya From KCB Group

Access Bank has officially taken over the National Bank of Kenya (NBK) after receiving final approval from regulators.

Jubilee Health Doubles Profit, Reports 142% Surge in 2024

Jubilee Health Insurance Limited (JHIL) has posted a 142% rise in profit before tax for 2024, reaching KES 1.22 billion.

Safaricom Schedules M-Pesa Maintenance for April 7, 2025

Safaricom has announced that its M-Pesa mobile money service will undergo scheduled maintenance on Monday, April 7, 2025, from 1:00 am to 1:30 am.

Dow Plunges 1,475 Points as Trade War Fears Rattle Markets

U.S. stocks took a major hit on Friday, with the Dow Jones Industrial Average dropping nearly 1,500 points by mid-morning.

China Hits Back with 34% Tariff on All U.S. Imports

China has announced that it will begin imposing a 34% tariff on all U.S. imports starting April 10, 2025.

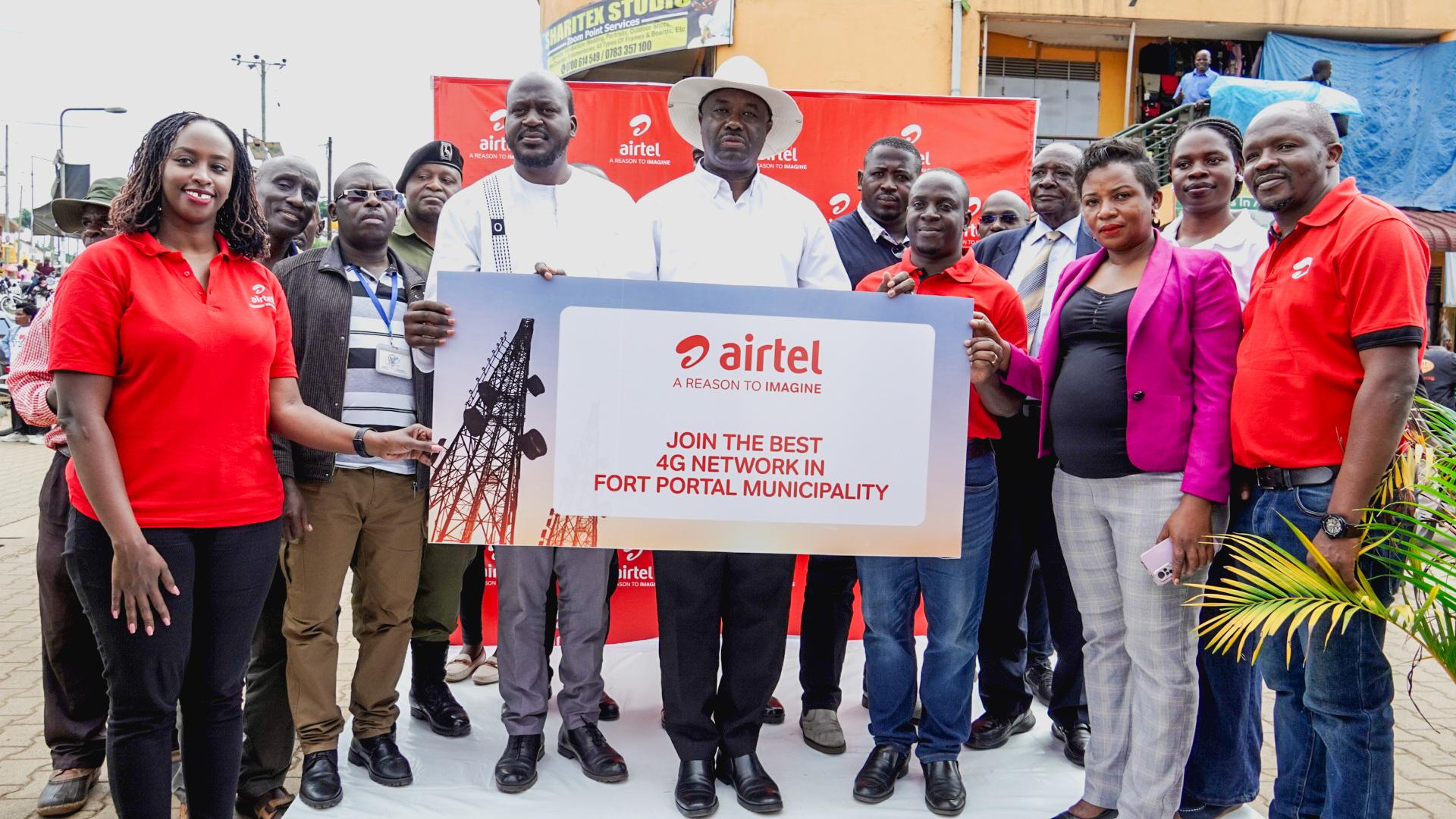

Airtel Uganda Expands Network in Fort Portal to Boost Tourism

Airtel Uganda has launched eight new network sites in Fort Portal City, strengthening its commitment to improving connectivity and accelerating digital transformation in the region.